*A quick note to blog readers: this is the first blog post in many months from my end, as I’ve been very busy with a number of initiatives, including ViTAA first and foremost. Thanks for reading and I’ll be sure to start posting more regularly again.

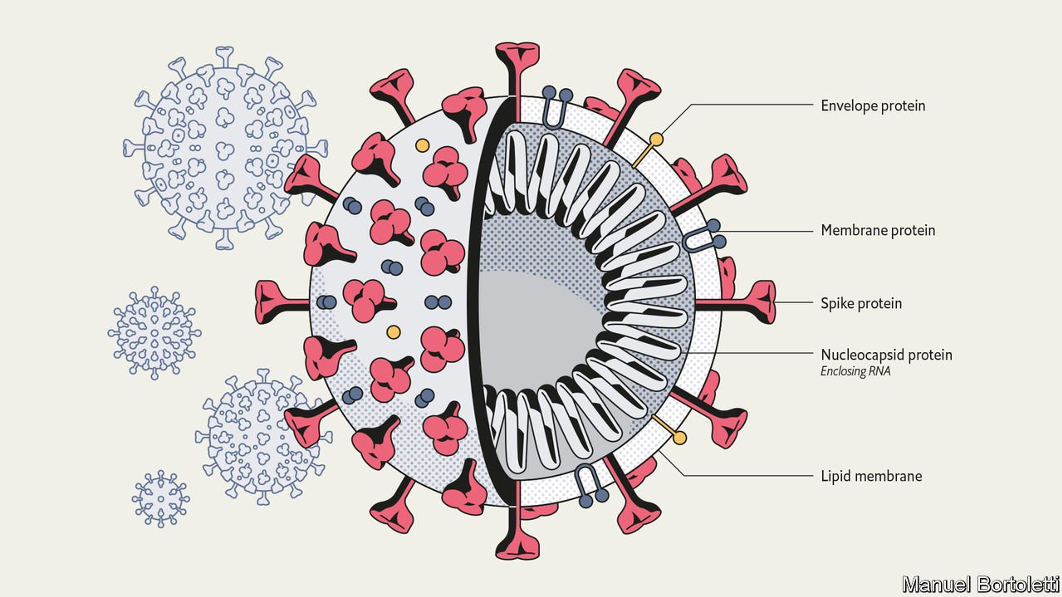

Financing a MedTech start-up is tricky, to say the least. No business momentum yet, no KOL network, no team - just vision, hope, lots of business potential and co-founders. And to top it off, in ViTAA’s case, a global pandemic with an unclear end in sight!

But first, I had to select the right financing vehicle for ViTAA’s early stage.

The concept of “tech value” at the POC (proof-of-concept) phase is difficult, if not unimaginable. Sobering technical, regulatory and financial risks lay ahead, with no guarantees they will be effectively addressed.

My first endeavour, once I was invited to come on board by Dr. Randy Moore and Dr. Elena Di Martino, was to build a world-class team. I had learned over my many financing activities that the investors’ assessment of the team was critical in the investment decision making.

In a MedTech start-up, several critical positions need to be dealt with, in the areas of product development, business development strategy, and regulatory planning. Harold Wodlinger, Dan Nahon, and Flor del Pilar Arana immediately came to mind.

I approached Harold to help produce a product development plan. His expertise and experience in software development were priceless. Dan Nahon rolled up his sleeves and helped me create an attractive business plan. Flor then joined the team and started to build the critical regulatory strategy so necessary to secure financing and ensure that the products and solutions developed by ViTAA meet the stringent governmental medical requirements for years to come.

With these critical people and plans now in place, we were now ready to execute a fundraising plan.

At this very early stage, it is virtually impossible to assess the tech value of a start-up technology. There are too many unaddressed risks to confuse the investors’ decisions; if technical, regulatory and IP risks are not effectively dealt with, a technology value is worthless. Proper execution of product development is critical to get the financing processes going.

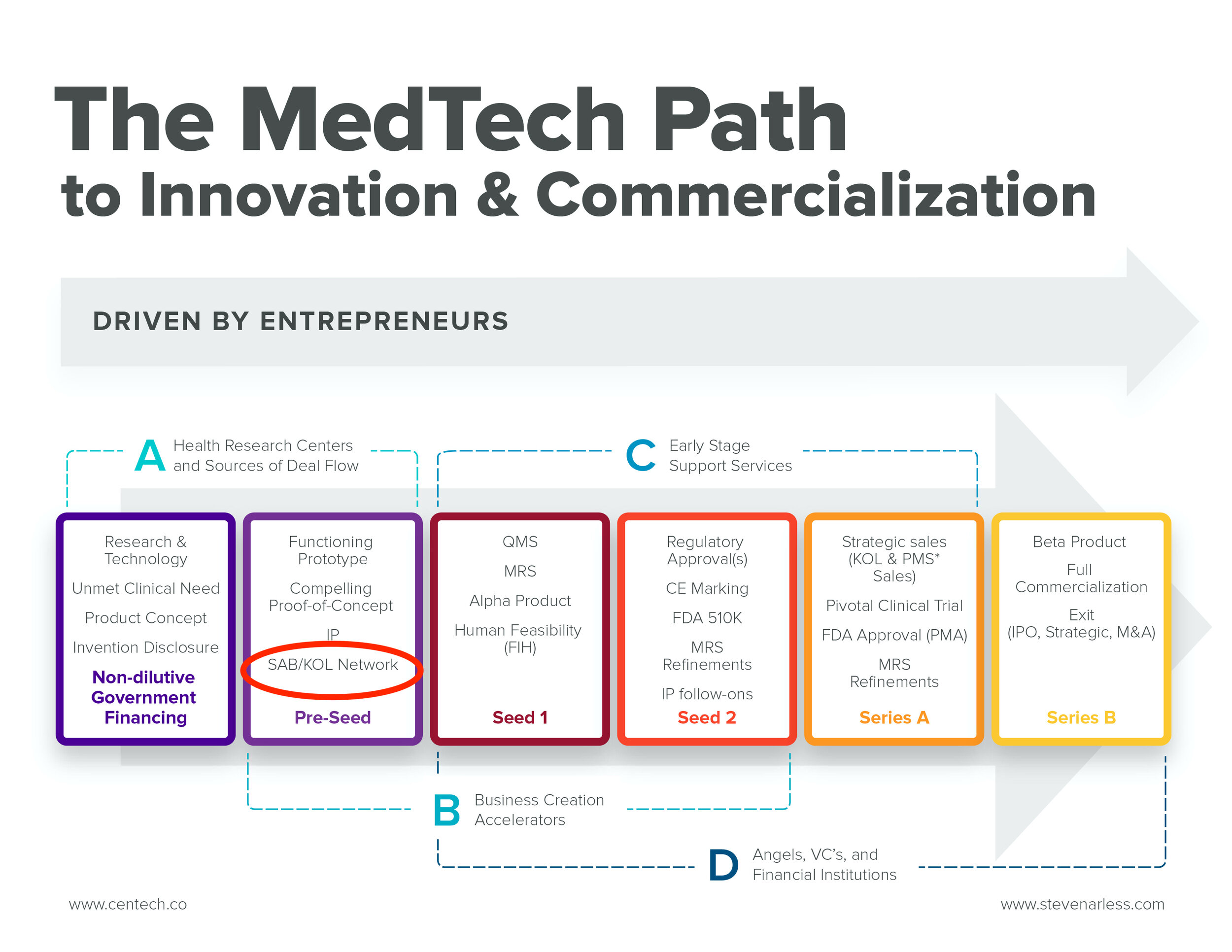

Consequently, early-stage, pre-seed, pre-clinical financings take on the form of convertible debt, meaning investors loan money to the start-up, typically at 8% interest, with a right to convert to equity priced by the lead investor at a Seed Round, anticipated 6-18 months into the future. This is the point when the start-up has virtually eliminated most of the technical and regulatory risks before a FIH ( first-in-human) feasibility study.

My new CFO, Ugo Cloutier, and I cobbled together a first convertible note with a floor of $500,000 and a ceiling of $1.25 million. I am pleased to report that although it took longer than expected (due to the pandemic-related challenges of doing due diligence and raising money virtually), we announced a very successful closing, hitting our ceiling of $1.25m on February 23, 2021. It’s a credit to the entire team that with determination and relentless effort we were able to achieve this success in the midst of the COVID-19 era.

Despite the challenges mentioned above, we managed to build an organization, implement a Quality Management System, develop prototype software into V1 of our commercial product and establish a world class advisory board (SAB) ready to lead the world’s first clinical registry for aortic aneurysms (AA).

Seeing that ViTAA was gaining momentum, both in terms of business milestones and awareness in the Quebec MedTech ecosystem, the obvious next step was to establish another convertible note to further accelerate the path towards the second iteration of our predictive software (V2). This will be the final financial stepping stone to a full-fledged equity round by the end of 2021, at which point ViTAA will likely be well-positioned for strategic commercialization, supported by a robust Series A financing.